MyGreenBucks Net Kenneth: A Deep Dive Into Financial Empowerment and Fintech Innovation

In today’s rapidly evolving financial landscape, platforms that simplify money management and empower individuals are more critical than ever. Among the rising names is MyGreenBucks Net Kenneth, a brand and personality that has sparked curiosity across the internet. Combining personal finance coaching with modern fintech solutions, MyGreenBucks Net Kenneth represents a blend of traditional financial wisdom and cutting-edge technology. This article examines the story, strategies, and impact of MyGreenBucks Net Kenneth, providing a comprehensive overview of why this platform and its founder, Kenneth Jones, have gained influence in both the personal finance and fintech sectors.

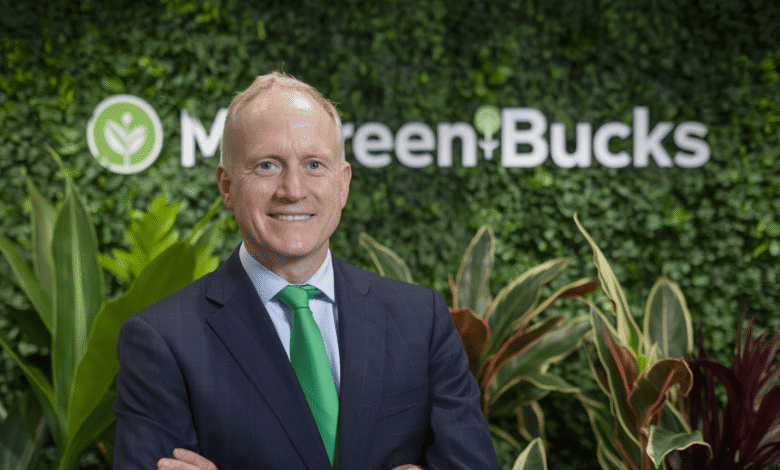

Who Is Behind MyGreenBucks Net Kenneth?

At the core of MyGreenBucks Net Kenneth is Kenneth Jones, a finance educator and entrepreneur passionate about making money management more approachable. Kenneth began as a self-taught blogger, writing straightforward, jargon-free content for everyday individuals struggling with budgeting, debt, and saving. His relatable tone helped demystify finance, earning him a growing community of readers.

Over time, Kenneth expanded his vision. Beyond being just a blog or resource hub, MyGreenBucks Net evolved into a robust fintech platform offering digital banking services, savings tools, and investment opportunities. This dual role—educator and innovator—makes Kenneth unique in a crowded industry.

The Mission of MyGreenBucks Net Kenneth

The central mission of MyGreenBucks Net Kenneth is financial empowerment. Kenneth believes that money management should not be limited to the wealthy or economic experts. Instead, everyone deserves access to practical tools, transparent banking, and sustainable investment opportunities.

His philosophy rests on three pillars:

- Accessibility – Breaking down financial concepts into everyday language.

- Sustainability – Encouraging ethical and eco-friendly investments.

- Innovation – Leveraging fintech to create more innovative money solutions.

MyGreenBucks Net Kenneth as a Personal Finance Coach

Before diving into its fintech empire, it’s essential to recognize how MyGreenBucks Net Kenneth started: as a personal finance coaching platform. Kenneth offered guidance in areas such as:

Budgeting Made Simple

Kenneth introduced frameworks like the 50/30/20 rule, envelope budgeting, and zero-based budgeting. His approach was never rigid but adaptable, making it easier for people to apply strategies to their unique lifestyles.

Debt Management

Debt payoff methods, such as the snowball (paying off small debts first) and avalanche (paying off high-interest debts first), were presented in clear, step-by-step guides.

Investment Education

Instead of overwhelming readers with Wall Street jargon, Kenneth promoted index funds, ETFs, and robo-advisors—tools that even beginners could navigate confidently.

Credit Building

Credit repair strategies, responsible credit card use, and methods for monitoring credit scores became recurring themes in his teachings.

This foundation created trust and credibility, which later fueled the transition into fintech services.

MyGreenBucks Net Kenneth as a Fintech Powerhouse

By 2018, Kenneth shifted gears and developed MyGreenBucks Net into a fintech platform with a focus on accessibility and innovation.

Features of the MyGreenBucks Net Platform

- Digital Banking

- No-fee checking accounts

- Automated savings features

- Instant peer-to-peer transfers

- AI-Driven Budgeting Tools

- Expense categorization

- Personalized savings recommendations

- Financial milestone tracking

- Investment Opportunities

- Low-cost portfolios for beginners

- Options for sustainable investing in green projects

- Blockchain-backed transparency in eco-initiatives

- Security Measures

- Military-grade encryption

- Real-time fraud monitoring

- Transparent transaction records

Impact in Numbers

- Over 500,000 active users.

- $2.5 billion in annual transactions processed.

- An average of 32% savings increase reported by users.

- 94% customer satisfaction rating.

These metrics highlight that MyGreenBucks Net Kenneth is not just a personal blog but a thriving digital ecosystem.

Recognition and Achievements of Kenneth

Kenneth’s work has not gone unnoticed. His efforts have earned him a spot on Forbes’ 30 Under 30 in Finance, and the MyGreenBucks mobile app consistently ranks high, with a 4.8/5 rating in app stores.

This recognition underscores the credibility of MyGreenBucks Net Kenneth as both a financial educator and fintech pioneer.

Sustainability: The Green Edge of MyGreenBucks Net Kenneth

One unique aspect of MyGreenBucks Net Kenneth is its eco-friendly financial model. Unlike many fintech competitors, Kenneth emphasizes sustainable investing by offering users the chance to fund projects such as:

- Renewable energy (solar, wind, hydro).

- Eco-conscious startups.

- Green bonds and ethical funds.

By combining profit with purpose, Kenneth empowers users to grow their wealth while supporting the planet.

Why MyGreenBucks Net Kenneth Stands Out

In a competitive space filled with budgeting apps, banks, and financial influencers, MyGreenBucks Net Kenneth stands out for several reasons:

- Human + Tech Blend – Kenneth provides relatable financial coaching alongside powerful fintech tools.

- Transparency – Blockchain integration and transparent reporting give users confidence.

- Eco Focus – Few platforms combine finance with sustainability as effectively.

- Community-Driven – From blog readers to app users, Kenneth cultivates a strong and loyal community.

Tips Inspired by MyGreenBucks Net Kenneth

If you’re new to personal finance or fintech, here are some actionable tips inspired by Kenneth’s philosophy:

- Start Small – Begin with basic budgeting before diving into complex investments.

- Automate Savings – Use digital tools to set aside money automatically.

- Avoid High Fees – Opt for low-cost funds and banking services.

- Stay Educated – Continuously read, learn, and update your financial strategies to stay informed.

- Invest Sustainably – Support green projects that align with long-term values.

The Future of MyGreenBucks Net Kenneth

Looking ahead, Kenneth’s platform aims to expand by:

- Introducing AI-powered robo-advisors for personalized investments.

- Partnering with global sustainability initiatives.

- Enhancing mobile features for an even smoother user experience.

- Growing its financial literacy network through workshops and digital communities.

With its dual role as a coaching hub and fintech ecosystem, MyGreenBucks Net Kenneth is positioned to remain a leader in personal finance innovation.

Conclusion

The journey of MyGreenBucks Net Kenneth is a testament to how passion, education, and technology can transform the financial industry. What started as Kenneth Jones’s personal finance blog has grown into a platform empowering hundreds of thousands of users to take control of their money.

You May Also Read: Invest1Now.com Stocks: A Comprehensive Guide for Modern Investors